Private Label Food and Beverages Market Size to Hit USD 393.60 Billion by 2034

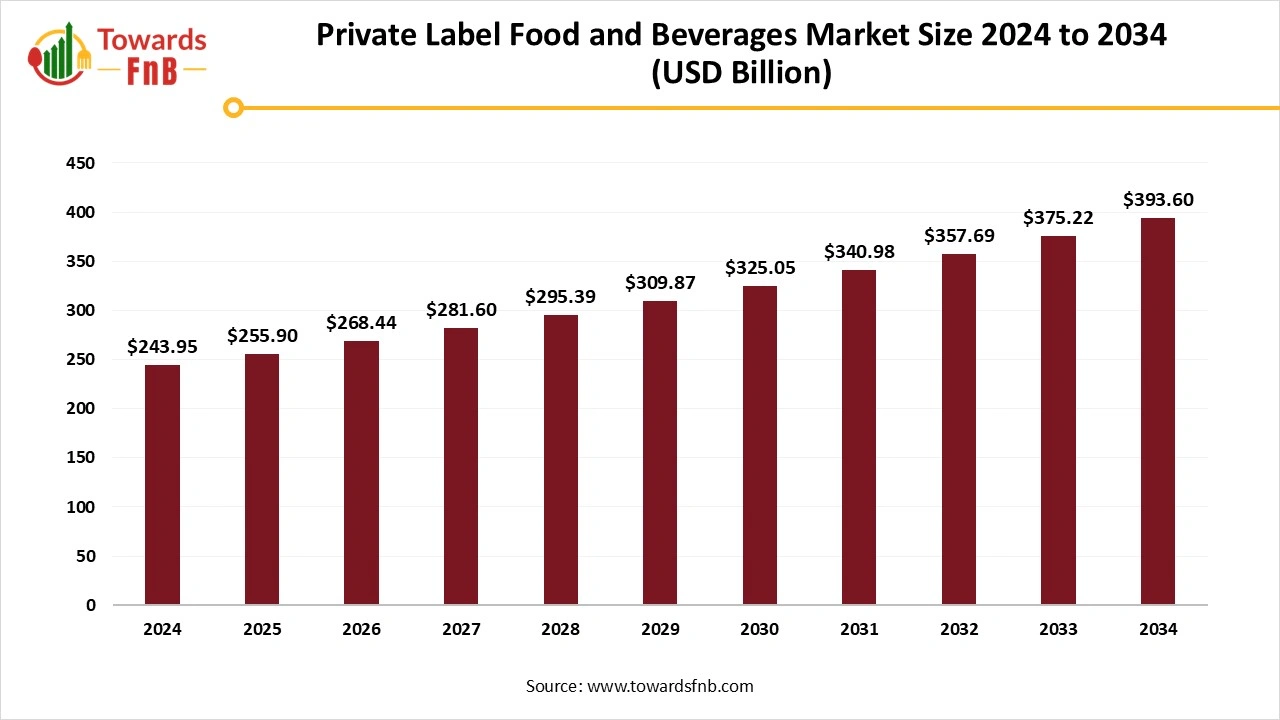

According to Towards FnB, the global private label food and beverages market size is calculated at USD 255.90 billion in 2025 and is forecasted to reach around USD 393.60 billion by 2034, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034. Driven by affordability, consumer trust, and expanding clean-label and plant-based offerings, the market is transforming global retail strategies.

Ottawa, July 29, 2025 (GLOBE NEWSWIRE) -- The global private label food and beverages market size stood at USD 243.95 billion in 2024 and is expected to grow from USD 255.90 billion in 2025 to around USD 393.60 billion by 2034, expanding at a CAGR of 4.9% from 2025 to 2034, according to study published by Towards FnB, a sister firm of Precedence Research.

The market has observed a huge spike in recent years due to price-conscious consumers, increasing trust in private labels, transparency levels of private labels, and exclusive offerings by retailers.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5710

Market Overview & Potential

The private label food and beverages are the products manufactured by a third party but sold under a retailer’s brand. These products are also termed as own brands, house brands, and store brands. These products are gaining traction in recent periods due to their perfect mimicking of branded products at reasonable prices. Hence, the private label food and beverages market has been observing a spike in recent years. The growing trust in private-label foods and beverages is also a huge growth driver for the market. The retailers ensure the pricing and quality of the foods and beverages sold under the retailers’ brand name to maintain the transparency and trust of consumers.

The market has grown significantly, especially in North America and Europe, with consumers now more willing to trust private labels due to their increased quality standards and sustainability initiatives. This shift in consumer behavior is particularly noticeable among the younger generations who are prioritizing health and transparency in their purchasing decisions.

Key Highlights of Private Label Food and Beverages Market

- By region, Europe led the market with the largest share of 16% in 2024, whereas the Asia Pacific is observed to be the fastest growing in the foreseen period due to rapid urbanization, increasing private labels in the region, and the growth of government-backed private labels.

- By food type, the bakery and confectionery segment captured the leading market share of 20% in 2024, whereas the frozen ready-to-eat meal segment is observed to be the fastest growing in the foreseen period due to its convenience factor, along with maintaining the quality of food.

- By drink product type, the non-alcoholic segment dominated the market with a 16% share in 2024, whereas the functional beverage segment is expected to grow in the foreseeable period due to the growth of a conscious consumer base and growing trust in private labels.

- By formulation, the clean label segment secured the leading market share of 25% in 2024, whereas the vegan/plant-based segment is expected to be the fastest growing in the foreseen period due to the increasing number of consumers opting for a vegan or plant-based cleaner diet.

- By packaging, the flexible packaging segment commanded the largest market share of 28% in 2024, whereas the tetra pack segment is observed to grow as it helps to enhance the shelf life of foods and beverages, along with maintaining sustainability.

- By sales channel, the supermarkets and hypermarkets segment dominated the private label food and beverages market in 2024, whereas the online retail segment is expected to grow in the forecast period due to its convenience factor, allowing consumers to trust private label products.

- By end consumer, the household/retail segment led the market with a dominant 65% share in 2024, whereas the foodservice segment is expected to grow in the forecast period due to growing food service outlets collaborating with private label food and beverages manufacturers.

- By pricing tier, the mid-range segment captured the largest market share of 40% in 2024, whereas the premium segment is expected to grow in the forecast period due to high demand for luxury and premium foods and beverages, especially by the younger generation.

New Trends of Private Label Food and Beverages Market

- High demand for quality products at reasonable prices has helped the growth of the private label food and beverage market in recent years. Many private label brands are marketing their private label products in an ideal way, which is helpful to attract customers to the brand.

- The improving quality of private label products and beverages, along with the affordability factor, is competing with branded labels, allowing the growth of the market.

- High availability of private label products in supermarkets, hypermarkets, convenience stores, e-retailers, and department stores is also helping the growth of the market by enhancing the consumer base of such stores.

- Growth of online platforms and e-commerce is also helping the growth of the private label food and beverages market, as it helps to enhance the consumer base of brands as well.

India, Germany & United States: What to Expect from These Countries in Private Label Food and Beverages Market?

India:

- Rising disposable income, especially in urban and growing tier‑II/III cities, is fueling demand for affordable yet quality private-label products.

- Increasing retail modernization, including supermarkets and online grocers, gives private label products higher visibility and accessibility.

- Retailers and e‑commerce platforms can leverage local manufacturing and tailor products to regional tastes and price points.

In India, private-label products are also gaining popularity due to the increasing penetration of online grocery stores, which provide easier access to quality private-label goods. Consumers in Tier II and Tier III cities are now able to purchase a wider range of private-label products at competitive prices.

Germany:

- Discounters like Lidl and Aldi, especially under Germany’s Schwarz Group, dominate with robust private-label portfolios and large-scale private brand production

- Retailers are differentiating through sustainable and health-focused private-label lines, including plant-based, vegan, organic products.

- Lidl Germany cut private-label vegan product prices by ~23% to match animal versions, boosting consumer experimentation and adoption.

United States:

- Economic pressure and inflation are driving consumers toward value-oriented store brands (e.g., Costco’s Kirkland, Walmart’s Bettergoods).

- Rising demand for healthier, plant-based, organic, and “clean-label” options within private-label offerings

- Retailers are investing in premium private-label lines and wellness-focused collections to appeal to younger, health-conscious consumers.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/private-label-food-and-beverages-market

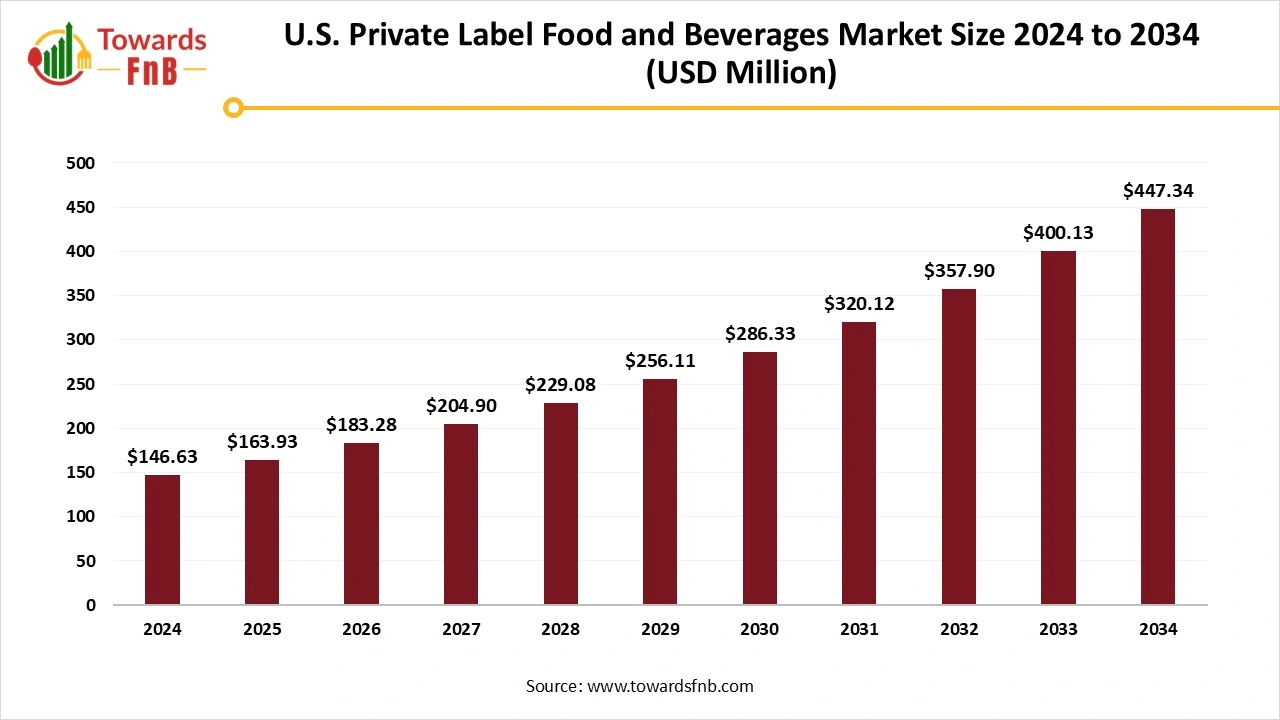

How Big is the U.S. Private Label Food and Beverages Market?

According to Towards FnB, The U.S. private label food and beverages market size was valued at USD 146.63 million in 2024 and is projected to grow to USD 163.93 million in 2025. By 2034, the market is expected to reach approximately USD 447.34 million, driven by a compound annual growth rate (CAGR) of 11.8% from 2025 to 2034. The market's growth is primarily fueled by innovations in product offerings and increasing consumer trust in private label brands.

U.S. Private Label Food and Beverages Market Key Takeaways:

- By Product Type (Food): The food segment held the largest market share in 2024, driven by rising demand for natural foods.

- By Product Type (Beverages): The beverages segment is projected to grow rapidly from 2025 to 2034, fueled by the expanding beverage industry.

- By Distribution Channel (Supermarkets & Hypermarkets): This segment dominated the market in 2024, supported by consumer preference for offline shopping.

- By Distribution Channel (E-commerce & DTC): Expected to grow significantly due to the increasing trend of online shopping.

- By Consumer Orientation (Budget-Conscious): Budget-conscious consumers led the market in 2024, driven by demand for affordable food and beverages.

- By Consumer Orientation (Health-Conscious): Health-conscious shoppers are expected to drive rapid market growth due to increased awareness of health and wellness.

- By Label Tier/Price Point (Value/Basic): The value/basic tier segment held the largest share in 2024, driven by a growing low-income consumer base.

- By Label Tier/Price Point (Premium): The premium tier is expanding at a significant CAGR from 2025 to 2034, fueled by demand for high-quality ingredients.

Note: This Report is Readily Available for Immediate Delivery| Download the Sample Pages of this Report@ https://www.towardsfnb.com/download-sample/5707

Recent Developments of the Private Label Food and Beverages Market

- In January 2025, the National Restaurant Association of India (NRAI) raised concerns over Swiggy and Zomato’s private-label food delivery, as it could be threatening for thousands of restaurants relying on these platforms' business. (Source- https://www.restaurantindia.in)

- In March 2025, The Kroger Co. fueled its brand expansion strategy by rolling out more than 900 new private brand products, with 370 new fresh items. The supermarket giant saw it as a traffic driver and margin enhancer. (Source- https://www.foodbusinessnews.net)

Market Dynamics

What are the Growth Drivers of the Private Label Food and Beverages Market?

There are multiple attributes contributing to the growth of the private label food and beverage market. Availability of quality products at affordable prices is one of the major factors helping the growth of the market. Such brands also offer transparency, allowing consumers to trust products and get quality products at lower prices. Hence, such factors also help in the growth of the market. The growth of online platforms and e-commerce platforms is another factor helping the growth of the private label food and beverage market. They allow consumers to purchase different types of products from the convenience of being at home.

Challenge

Low Trust Hampering Market’s Growth

Developing countries and regions have low trust in private label products; hence, such scenarios hamper the growth of the private label food and beverages market. Consumers in such countries prefer to shop from reputed brands and do not have an issue with paying more for such products. Hence, the growth of private labels under such situations is not easy. Therefore, such scenarios hamper the growth of the market. Consumers also ensure the ingredients used in the foods and beverages are ethically sourced and clean, and are also health-supportive. Such issues may arise while trusting private label products, hence such factors also hinder the growth of the market.

Opportunity

The Growing Dollar Value of Private Label Food and Beverages is helping the Growth of the Market in the Future.

The growing dollar value affecting the value of private label food and beverages is helping the growth of the private label food and beverages market in the foreseeable future. It helps to create lucrative scenarios for consumers to purchase such products, further fueling the growth of the market. To further enhance the growth of such products, the private label products are available in department stores, dollar stores, and other retail stores as well.

Private Label Food and Beverages Market Regional Analysis

Which Region Dominated the Private Label Food and Beverages Market in 2024?

Europe dominated the private label food and beverages market in 2024 due to various factors that helped the growth of the market. Availability of high-quality products at affordable prices is one of the major factors helpful for the growth of the market in the region. Private label food and beverages are an ideal mimic of branded products at affordable prices. Hence, it also helps in the growth of the market. Availability of such products easily at convenience stores, department stores, online platforms, and e-commerce platforms also aids the growth of the market in the region.

What to Expect from Asian Countries in Private Label Food and Beverages Market?

Asia Pacific is expected to grow in the forecast period due to multiple reasons, helping the growth of the market in the region. Rapid urbanization, rising disposable income of consumers, and the growing food and beverage industry are some of the major factors helping the growth of the market. High demand for clean-label products is also one of the major reasons for the growth of the private-label food and beverages market in the region. Busy lifestyle, hectic schedules, strengthening government support, and high demand for ready-to-eat products are other major reasons for the growth of the market.

Private Label Food and Beverages Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 4.9% |

| Market Size in 2024 | USD 243.95 Billion |

| Market Size in 2025 | USD 255.90 Billion |

| Market Size by 2034 | USD 393.60 Billion |

| Dominated Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Private Label Food and Beverages Market Segmental Analysis

Food Type Analysis

The bakery and confectionery segment dominated the private label food and beverages market in 2024 due to its affordability factor, helping consumers get quality and affordable bakery goods. Hence, the segment dominated the market. The segment is also observing growth due to the availability of specialty bakery goods such as lactose-free, gluten-free, sugar-free bakery goods for people with particular choices or health concerns.

The frozen ready-to-eat segment is expected to grow with the highest CAGR in the foreseen period due to its convenience factor, allowing consumers to consume high-quality foods and beverages at affordable prices and without the hassle of preparing a meal. Hence, consumers prefer to pick such products for huge gatherings, parties, or similar occasions.

Drink Product Type Analysis

The non-alcoholic segment dominated the private label food and beverages market in 2024 due to high awareness among consumers about the side effects of alcohol. Hence, consumers today prefer the alcohol competitor drinks such as flavored water, fruit juice, and other energy drinks, which are helpful to maintain the energy levels of a consumer, along with maintaining overall health.

The functional beverages segment is expected to grow in the foreseeable period due to the increasing number of health-conscious consumers. Consumers today prefer to consume beverages made from specialty ingredients that are helpful to maintain overall health. Vegans and plant-based diet followers also help to enhance the growth of the market in the foreseeable period.

Formulation Analysis

The clean label segment dominated the private label food and beverages market in 2024 due to high demand for clean label products by consumers for maintaining overall health and the rising health-conscious attitude of consumers in recent times. Consumers prefer to shop for products with precise ingredient information, and hence, the segment led the market. Clean-label logos and certifications also help in the growth of the market by enhancing its consumer base.

The vegan/plant-based segment has been observed to grow in recent years due to a high population opting for veganism to acquire its enhanced health benefits. A major percentage of the population today prefers a plant-based or vegan diet due to its array of health benefits. Food and beverages under the private label category are of high quality and at affordable prices, with vegan and plant-based options as well for vegans. Hence, the segment is observed to grow in the forecast period.

Packaging Analysis

The flexible packaging segment dominated the market in 2024 due to its multiple positive attributes, such as cost-effectiveness, easy transportation, enhancing product shelf life, and recycling ability. The segment also dominated the market due to its reliable and high-quality nature, which is helpful to keep the food and beverages safe.

The tetra pack segment is expected to grow in the foreseen period due to its multiple benefits, which are helpful for consumers. Tetra packaging allows consumers to extend the shelf life of the product and maintain its quality even in room temperature conditions. Tetra packaging also helps consumers to carry food or beverages outdoors or while traveling and maintain hygiene levels. Hence, the segment is observed to grow in the foreseen period.

Sales Channel Analysis

The supermarkets/hypermarkets segment dominated the private label food and beverages market in 2024 due to the availability of different brands and categories of products under one roof. It allows customers to shop for different types of products as per their convenience under a single roof. Customers also gain access to multiple private-label products, further fueling the growth of the market.

The online retailer segment is expected to grow with the highest CAGR in the forecast period due to its convenience factor. The growth of online and e-commerce platforms enhances the growth of the segment in the foreseen period. Consumers today prefer to order online to avoid visiting physical stores and get desired products in different price ranges and to avail multiple available discounts. Hence, the segment is observed to grow in the expected timeframe.

End Consumer Analysis

The household/retail segment dominated the private label food and beverages market in 2024 due to high demand from retailers and the household segment for quality products at affordable prices. The requirement is prime by the segment and hence led the market in 2024. Availability of high-quality products at lower prices helps to strengthen the trust of consumers, further enhancing the consumer base of the brand, which further fuels the growth of the market.

The foodservice segment is expected to grow with the highest CAGR in the expected timeframe due to the expansion of multiple food and beverage outlets globally. Such food joints also promote private-label foods and beverages, which are helpful for their growth, along with enhancing the growth of the private-label food and beverages market. Hence, the segment is expected to grow in the future.

Pricing Tier Analysis

The mid-range segment dominated the private label food and beverages market in 2024 due to the availability of private label foods and beverages of high quality at affordable prices. It allows consumers to get access to quality products at lower prices, which is the prime demand of consumers these days. Hence, the segment led the private label food and beverages market in 2024.

The premium segment is expected to grow in the forecast period due to high demand for premium and luxury segment products to ensure their quality and reliability. The Gen Z and millennials form a huge consumer base for this segment, as the generation showcases value-conscious purchasing. Hence, the segment is observed to grow in the forecast period.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Probiotics Animal Feed Market: The global probiotics animal feed market size was estimated at USD 4.99 billion in 2024 and is expected to rise from USD 5.44 billion in 2025 to nearly reaching USD 11.72 billion by 2034, growing at a CAGR of 8.86% during the forecast period from 2025 to 2034.

- Feed Phosphate Market: The global feed phosphate market size is rising from USD 2.82 billion in 2025 to USD 4.75 billion by 2034. This projected expansion reflects a CAGR of 5.96% throughout the forecast period from 2025 to 2034.

- Textured Vegetable Protein Market: The global textured vegetable protein market size is expected to grow from USD 1.92 billion in 2025 to USD 3.48 billion by 2034, at a CAGR of 6.97% over the forecast period from 2025 to 2034.

- Organic Pet Food Market: The global organic pet food market size is projected to expand from USD 2.54 billion in 2025 to USD 4.41 billion by 2034, growing at a CAGR of 6.34% during the forecast period from 2025 to 2034.

- Europe Protein Market: The Europe protein market size is projected to expand from USD 6.39 billion in 2025 to USD 10.02 billion by 2034, growing at a CAGR of 5.12% during the forecast period from 2025 to 2034.

- Milk Protein Market: The global milk protein market size is expected to grow from USD 14.65 billion in 2025 to USD 25.39 billion by 2034, at a CAGR of 6.3% over the forecast period from 2025 to 2034.

- Canada Food Service Market: The Canada food service market size is course to grow from USD 135.63 billion in 2025 to USD 583.47 billion by 2034, growing at a CAGR of 17.6% during the forecast period from 2025 to 2034.

- Wet Pet Food Market: The global wet pet food market size is projected to witness strong growth from USD 27.90 billion in 2025 to USD 41.75 billion by 2034, reflecting a CAGR of 4.58% over the forecast period from 2025 to 2034.

Key Players in Private Label Food and Beverages Market

- PLMA

- Cott Corporation (Now Primo Water)

- TreeHouse Foods

- Reinhart Foodservice

- ConAgra Brands (for private labels)

- Bimbo Bakeries USA

- Greencore Group

- Pinnacle Foods (acquired by ConAgra)

- George Weston Foods

- Seneca Foods Corporation

- Lactalis Group (for private label dairy)

- SunOpta Inc.

- Post Holdings

- Del Monte Foods (for store brands)

- Aryzta AG

- Sovos Brands

- Mistral Group

- Ornua Ingredients

- Kroger's Manufacturing Division

- Costco (via Kirkland Signature, contract manufacturing)

Segments Covered in the Report

By Product Type

Food

Bakery & Confectionery

- Breads

- Cakes & Pastries

- Biscuits

- Chocolates

- Candies

Snacks

- Potato Chips

- Popcorn

- Energy Bars

- Nuts & Seeds

Dairy Products

- Milk

- Cheese

- Yogurt

- Butter

Frozen Foods

- Frozen Vegetables

- Ready-to-Eat Meals

- Ice Creams

Beverages

- Juices

- Soft Drinks

- Bottled Water

- Functional Drinks

Sauces, Condiments & Dressings

- Ketchup

- Mayonnaise

- Salad Dressings

- Dips & Spreads

Pasta, Rice & Cereals

- Breakfast Cereals

- Pasta

- Rice

Meat, Poultry & Seafood

- Fresh

- Frozen

- Canned & Preserved Foods

Canned Vegetables

- Canned Meat & Fish

- Preserves & Jams

By Drink Product Type Insights

Alcoholic

- Beer

- Wine

- Spirits

Non-Alcoholic

- Bottled Water

- Juices

- Carbonated Drinks

- Sports & Energy Drinks

- Tea & Coffee (RTD)

By Formulation / Health Claims

- Organic

- Gluten-Free

- Vegan/Plant-Based

- Low Fat/Sugar/Sodium

- Fortified (e.g., with Vitamins, Minerals, Protein)

- Clean Label

- GMO-Free

- Functional (Probiotics, Antioxidants)

By Packaging Type

- Flexible Packaging

- Rigid Packaging

- Tetra Packs

- Bottles (Glass/PET)

- Cans

- Cartons

- Pouches

- Jars

By Sales Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Discount Retailers

- Club Stores (e.g., Costco, Sam’s Club)

- Specialty Stores

- Direct-to-Consumer (D2C)

By End Consumer / Application

- Household/Retail Consumers

- Foodservice (Hotels, Restaurants, Cafes)

- Institutions (Schools, Hospitals)

- Industrial (Used as Ingredients)

By Pricing Tier

- Economy

- Mid-Range

- Premium

- Value-Added / Niche

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/price/5710

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.